Types of Forex Orders: 6 Key Takeaways

Navigating the world of forex trading can feel as complex as deciphering a cherished family recipe passed down through generations, especially with different types of forex orders to pick from. But fret not, fellow traders! Whether you’re taking your first steps or sailing with the seasoned, join us for an approachable exploration of the diverse world of forex orders.

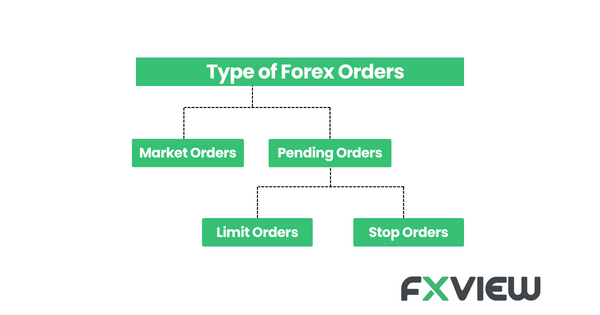

Let’s kick off with the Market Order

This is your go-to, the bread and butter of trading. It’s like snagging a deal during a flash sale – you see what you want, you click “Buy Now,” and you secure it at the current market price.

Let’s know about the Pending Order

Pending order in the world of trading is like having a superpower – it lets you set the stage for future trades. Imagine this: you’ve got your eyes on a particular stock, but it’s just a tad too expensive right now. Instead of waiting around, you can place a pending order that says, “Hey, when this stock hits the price I want, make the trade!”

Here’s where it gets interesting: there are different types of pending orders, like “Limit” and “Stop.”

Now, let’s delve into the Limit Order

Consider this your personal shopper. You set the price, and when the market reaches that threshold, your order is executed. Think of it as your virtual assistant, snagging that limited-edition item as soon as it hits your desired price.

In the midst of market chaos, say hello to the stop order (also known as the stop loss order).

This trusty companion steps in when you need it most. It’s your safety net, helping you exit a trade if things go south or locking in profits when the tides turn. Picture it as your financial guardian, stepping in just when things get too rocky.

And then we have the Trailing Stop Order

Think of this as your steadfast co-pilot. Like a loyal partner, it follows your lead, ensuring that as the market moves in your favour, your profits stay secure and your losses remain manageable. It’s like having a savvy teammate watching your back, adjusting as needed while you navigate the trading waters.

There you have it – a comprehensive yet relaxed breakdown of forex orders. With this newfound knowledge, you’re ready to dip your toes into the world of forex trading.

Key Takeaways from Forex Orders

- Forex orders are essential tools in the world of currency trading, offering control, speed, precision, and protection.

- They serve as dependable partners for traders, helping them navigate the complexities of the forex market effectively.

- Market orders provide swift execution, allowing traders to quickly enter or exit a position in a fast-moving market.

- Limit orders offer precision by allowing traders to specify their desired entry or exit price, ensuring they capture opportunities at their preferred levels.

- Stop orders act as protective shields, helping traders limit losses and secure gains by triggering an order when a certain price level is reached.

- Trailing stop orders are dynamic tools that adjust to market conditions, allowing traders to lock in profits and manage potential losses as prices move in their favour.

- Understanding and using these forex orders is like having a flexible toolkit at your disposal to enhance your trading strategy and success.

Conclusion

Now, armed with this newfound knowledge, you’re not just prepared – you’re empowered to navigate the intricate world of trading with confidence. Much like a seasoned explorer who has meticulously studied ancient maps, you now possess the tools to navigate the ever-evolving trading landscape, seize fleeting moments of opportunity, and emerge as a shrewd and skilled forex trader. So, set sail with confidence, and may your trading journey be filled with success and prosperity.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.