Swing Trading in Forex: A Beginner’s Guide!

Swing trading in Forex is a globally embraced strategy. What exactly is it? How does it function, and which indicators are most effective for it? Can swing trading be profitable? This guide will answer all the questions you have been wanting to know.

Meaning of Swing Trading in Forex

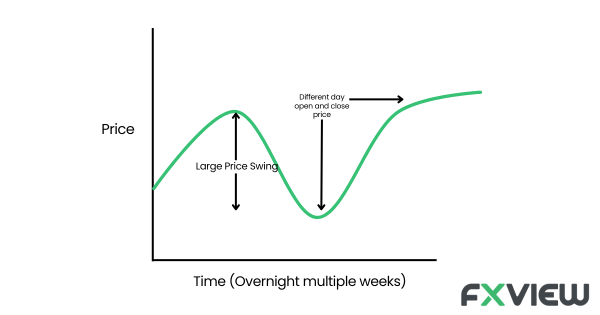

Swing trading is a strategy popular among traders across the world who don’t like to monitor screens constantly nonstop. Unlike day trading, which seeks to profit within a single day, swing trading looks to exploit potential short-term trends that last anywhere from a few days to several weeks. Swing trading uses technical analysis to recognize patterns and indicators to predict future price moves.

How does Swing Trading work?

Swing trading in Forex is about analyzing market conditions to identify trends and potential entry and exit points. Let’s understand how it works:

- Identify Trends: By using charts and technical analysis, swing traders look for trending or potential trending market conditions.

- Utilize Indicators: Tools like Moving Averages, Relative Strength Index (RSI), or Bollinger Bands are vital in predicting price movements.

- Select a Strategy: Traders should choose a strategy that matches their risk tolerance and market analysis.

- Enter and Exit: Knowing when to enter and exit a trade is crucial. Swing traders often set stop-loss and take-profit levels to manage their risks.

Swing Trading Indicators

Indicators of Swing Trading are important for forecasting potential price movements & trends. These are some of the following indicators:

- Moving Averages (MA): May help to smooth out price action and identify the direction of the trend.

- Relative Strength Index (RSI): May measure momentum and can indicate overbought or oversold conditions.

- Bollinger Bands: Can give clues about market changes and possible price reversals.

- Fibonacci Retracements: Can help identify key support and resistance levels.

Swing Trading Strategies include

It actually depends on various factors:

- Trend Following: Utilizing indicators to follow a trend, entering and exiting in alignment with that trend.

- Breakout Trading: Entering a trade when the price breaks through a significant level, indicating a possible continuation of a trend.

- Counter-Trend Trading: Trading against the trend, which can be riskier but may offer opportunities during market corrections.

Is Swing Trading an option for all traders?

Swing trading is not for everyone. You need to know the market, be patient, and use tools and plans well. With the correct approach, it can be exciting.

Difference between Day Trading and Swing Trading

While both are popular trading styles, they have distinct differences:

- Day Trading: Focuses on intraday movements, requires constant monitoring, and positions are closed within the same trading day.

- Swing Trading: Aims for potential gains over several days or weeks, requires less screen time, and utilizes short to medium-term trends.

However, both trading styles require proper risk management, patience, practice, and market knowledge, and traders should perform educational research to be able to make informed decisions and plan their next moves.

Benefits and Limitations of Swing Trading in Forex

Swing trading has both benefits and drawbacks.

Benefits:

- Time-saving

- Employing Strategic Planning

Limitations:

- Requires in-depth market knowledge

- Risk of significant losses

- Stressful during market fluctuations

Can Swing Trading be profitable?

It could be, however, that the potential profit a trader may earn depends on the trader’s skills, strategies, market conditions, and risk management. It’s essential to recognize that while any potential success in swing trading might be possible, there’s no guaranteed winning strategy. It does not guarantee any profits and there is always the high risk of losing the amount invested.

More tips for Swing Traders

- Education: Continuous learning about the Forex market, strategies, and indicators is vital.

- Demo Trading: Practice with a demo account to enhance confidence and understand strategies without risking real money.

- Risk Management: Implementing proper risk management techniques may prevent catastrophic losses.

- Stay Updated: Follow market news and global events to understand potential market directions.

Is this trading style suitable for everyone?

Not necessarily. One needs to invest in knowledge, time, and tools available. But for those willing to invest in learning and practicing, swing trading can be an option to explore in the Forex market. Just remember, like all trading styles, there are risks. However, the key is to observe and manage them, which is important in order to make informed decisions.

Conclusion

Swing trading in Forex can be considered as a market timing strategy while investing in financial instruments, however used with the correct approach and tools.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.