Diversification

Embarking on the vast journey of forex trading as a novice can seem daunting, akin to venturing into a thick forest without a compass. But here’s the good news – there’s a compass called ‘Diversification’ that can guide you through the process.

Let’s take a closer look at diversification, understand what it’s all about, and see how it can help make our forex journey smoother.

Understanding the concept of Diversification

Imagine you’re setting out on a voyage. Would you rely on a single route, or would you map out multiple paths? Diversification is the latter. It’s like spreading your investments in various places; if one doesn’t work out, you have others to fall back on. In the forex world, it’s about not getting too attached to a single currency or asset and thereby mitigating the pitfalls.

Planning your road to Diversification

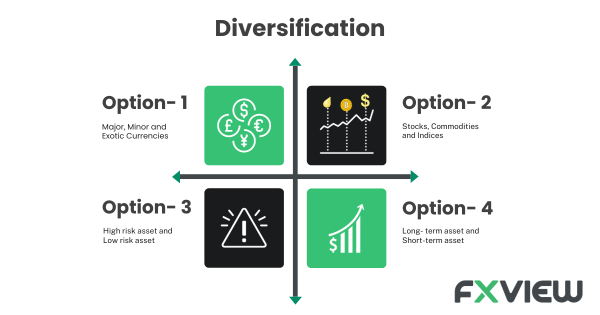

Plotting a diversification route in forex isn’t about random selection. It’s a pre-decided strategy. Here’s your guide:

- Currency Expeditions: Don’t remain anchored to one currency pair. Venture into the waters of major, minor, and even the exotic currency shores. Each has its own structure and characteristics, and by mixing them up, you may get a richer overall experience. Diversifying in trading is similar; it gives you a fuller story and may allow you to weather the highs and lows better.

- Temporal Tides: Possibility to swing between short-term thrills and long-term voyages.

- Beyond the Forex Horizon: The Forex sea is vast, but there are other oceans. You have opportunities to dip your toes into stocks, commodities for global clients.

- Risk Compass: Set your boundaries. Know how deep you can dive. Check the assets that correspond with your risk appetite.

Why sail the Diversified seas?

Diversification isn’t just about spreading your risk exposure. It’s like being a sailor who knows every wave of the sea, ensuring a smoother journey.

- Navigating Storms: It’s your shield against the tempests. One currency might be in turmoil, but others might be calm, balancing your journey.

- Consistent Winds: With diversification, you catch different winds.

- Clear-headed Captaincy: A diversified portfolio could make you a calmer captain. You’re not emotionally swayed by the tide of a single asset.

- Steady Ship: With a mix of different assets, your ship doesn’t tilt too much on one side. It could remain stable amidst the market’s waves.

Finding your true north through Diversification

It’s about being cautious in diversity. If you’re sailing only towards a single island and it’s hit by a storm, your entire voyage is at risk. But if you’ve charted a course across multiple islands, the calmness of one can offset the storms of another. That’s the true essence of diversification – ensuring your journey remains, on balance.

Crafting the perfect voyage plan

A diversified portfolio is your ship equipped with the useful tools:

- Destination Clarity: Understand your journey’s purpose. What do you want?

- Proper Provisions: Don’t stock up only on one type of provision. You can mix your assets – different currencies, time horizons, and even beyond forex.

- Regular Course Checks: Even the best sailors need to check their course. Regularly review and adjust your asset mix.

Steering your Diversification ship

Diversification is not about setting sail and forgetting. It’s about constantly adjusting your sails:

- Map Study: Delve deep into research. Understand different currencies, their past routes (historical data), and the current winds (market trends).

- Smart Allocation: Distribute your resources (capital) wisely, so you’re ready for any turn.

- Vigilant Lookout: Keep an eye on the horizon. Adjust your sails (portfolio) as the winds (market conditions) change.

Conclusion

Diversification, in the vast sea of forex, is your loyal first mate, ensuring you don’t go off course. It may help protect against unexpected challenges, ensure a steady journey, and keep things balanced. As you set sail into the forex world, remember to carry this compass called ‘Diversification’.

Happy Trading!

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.