10 Types of Forex Scams

Forex trading, the buying and selling of currencies on the foreign exchange market, has grown immensely in popularity. Engaging in forex trading presents both opportunities and risks, including the potential for falling victim to the forex scam types. This comprehensive guide aims to shed light on the various types of forex scams, how to identify them, and strategies to strengthen your safety.

What is a Forex Scam?

The Forex scams involve deceptive tactics that aim to deceive traders, particularly those who are new to the market. Such scams can go from fake investment opportunities to fraudulent brokers. Understanding what constitutes a forex scam is the first step to avoiding it.

Recognizing a Forex Scam: What to look for?

- Overly Optimistic Promises: Beware of promises that seem too good to be true. Be cautious of claims of substantial profits with little to no risk as it can be one of the forex scam types.

- Unregulated Brokers: Verify the broker’s registration with appropriate financial authorities. Check directly with the regulatory agency’s register to confirm their legitimacy.

- Aggressive Marketing Tactics: Stay alert for high-pressure marketing tactics.

- Scammers may use unsolicited calls, emails, or messages to rush you into investing.

- No Trading History: Demand proof of a trading system’s performance.

- Be Wary of Systems or Individuals that lack historical data or verifiable evidence of their trading success. Recognizing these signs and clues can help you protect your investments and avoid falling victim to fraudulent forex scam types schemes, including spot forex scams.

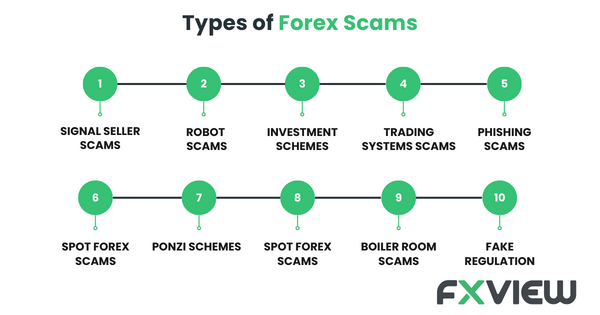

10 Forex Scam Types

Certainly, here are concise descriptions for each of the forex scam types:

- Signal Seller Scams: These scams promise insider information and profitable trading signals but often deliver false or unreliable signals.

- Robot Scams: Robot scams promote automated trading systems with exaggerated profit claims, but they often fail to deliver as promised.

- Investment Schemes: Investment schemes offer seemingly lucrative opportunities with high returns but usually lack substance and are designed to deceive investors.

- Broker Scams: Broker scams involve dishonest brokers using unethical practices, like trade manipulation or withdrawal refusal, to exploit traders.

- Trading Systems Scams: Trading systems scams promise substantial profits through automated strategies but lack transparency and may use fictional performance data.

- Phishing Scams: Phishing scams aim to steal personal and financial information through deceptive emails or messages.

- Spot Forex Scams: Spot forex scams target the spot forex market, promising big gains without providing verifiable proof or historical data.

- Ponzi Schemes: Ponzi schemes use new investors’ money to pay earlier investors, ultimately collapsing when new investments dwindle.

- Boiler Room Scams: Boiler room scams use high-pressure sales tactics to promote and sell often worthless or overpriced investments.

- Fake Regulation: Some scams falsely claim to be regulated or impersonate regulated brokers using fake or misleading information. Traders should verify broker legitimacy with the appropriate regulatory authorities.

To protect yourself from forex scam types, educate yourself, choose reputable & licensed brokers, practice risk management, and avoid “get-rich-quick” promises and unsolicited offers. Stay informed and vigilant.

Key Takeaways

- Forex trading offers both opportunities and risks, including the potential for falling victim to scams.

- Recognizing forex scams is crucial for safeguarding your investments.

- Warning signs of forex scams include overly optimistic promises, unregulated brokers, aggressive marketing, and a lack of trading history.

- Common forex scam types include signal seller scams, robot scams, investment schemes, Ponzi schemes, boiler room scams, and fake regulation claims.

- Staying informed, conducting thorough research, and trusting your intuition are essential for protecting yourself in the forex market.

Conclusion

In the rapidly evolving world of forex trading, awareness of forex scam types is paramount. By identifying these scams and conducting thorough research, you can protect your investments and avoid forex scams. Trust your intuition—if something feels off, step back. Your financial security may depend on it. Stay informed and cautious in the forex market.

Disclaimer: The information in this article is provided for educational and informational purposes only and is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.