Bear and bull market in Forex

Hey there forex enthusiasts! In the thrilling world of trading, two terms often steal the spotlight – “bear and bull market in forex.” But what do these animal-themed terms really mean? And how can they impact you, the trader? Let’s understand.

Bull market

Imagine a bull charging with its horns raised; this is a perfect analogy to remember the concept. In a ‘Bull Market’, prices are on an upward trend, they’re charging forward with full steam, just like the bull. In the bull market, traders tend to be optimistic, expecting prices to rise even further

Bear market

On the other hand, a ‘Bear Market,’ crucial in the discussion of bear and bull market in forex, is the exact opposite. Picture a bear swiping down with its paws, symbolizing a downward trend. During a ‘Bear Market,’ traders tend to be pessimistic, expecting prices to continue falling, which is a typical sentiment in the bear market in forex. This could be an opportune moment to sell a currency pair, anticipating a further decline in its value.

You may be wondering, what on earth can nudge a peaceful market into the bullish charge or a bearish pounce within the bear and bull market in forex? Let’s roll up our sleeves and uncover these key factors.

Economic indicators: As clear as a bell

Economic indicators, my friends, are like the pulse of a country’s economy and are indicative of a bear and bull market in forex trends. They involve an array of statistical data, including inflation rates, unemployment, retail sales, GDP growth, etc. Think of it this way, when the economic health of a country is booming, it’s like music to traders’ ears, leading to a bullish trend in the bear and bull market in forex. Conversely, if the economic indicators hit a sour note (i.e., negative economic news), traders brace themselves for a potential bear market scenario in the bear and bull market in forex.

Monetary policy: The ace pp Central Banks’ sleeves

Now, here’s a secret weapon that can shift the Forex market like the flip of a coin: the monetary policy set by central banks which plays a pivotal role in the bear and bull market in forex dynamics. Imagine the Central Bank as the puppeteer and the Forex market as the puppet show. When they pull on the strings of interest rates or tweak the puppet of unconventional policies like quantitative easing, the currency’s strength can sway dramatically, influencing the bear and bull market in forex. This movement can either fuel the bullish rocket or set off the bearish domino effect.

Political stability: A slippery slope

Picture this: a house (country) with a stable foundation (strong political environment) is far more appealing than one that’s tottering on the brink of a cliff (political uncertainty), especially in the context of bear and bull market in forex. Stability can give traders confidence, which tends to lead to bullish trends. On the other hand, political uncertainty can be like stirring up a hornet’s nest, causing traders to be cautious and potentially resulting in a bearish trend in the forex market.

Global market sentiment: The weather vane of forex

The forex market can be a mirror reflecting global market sentiment. When the global market is riding high, it can be sunshine and rainbows for the forex market too, steering it towards bullish terrain in the forex market. On the flip side, if global markets are under the weather, forex may follow suit and enter bearish territory, signaling a phase in the forex market.

How do these impact you, the trader?

Bull markets may offer opportunities for traders as consumer confidence and spending increase signaling an uptrend in the market. The music and lights should not, however, cause you to lose focus on the potential for overvaluation and bubbles, which are also a part of the bear and bull market in the forex dynamic. It’s crucial to do your homework and have a plan B.

Bear markets, while seemingly daunting, reveal a silver lining for the resilient trader in forex, offering the chance to find quality assets at lower prices. It’s a time when strategic decisions in forex become paramount to future success.

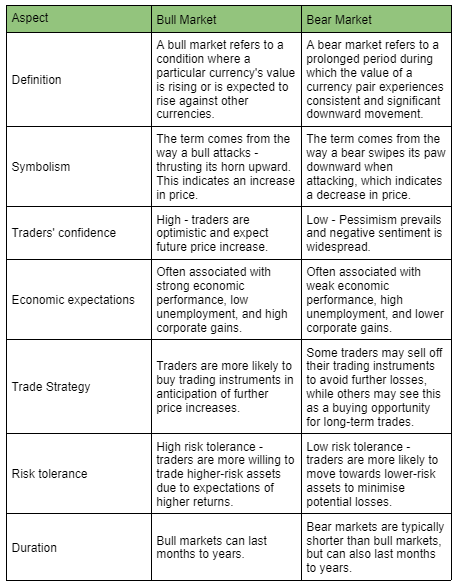

Bull Vs Bear

Remember that these are common trends that can change depending on market conditions, significantly influencing the bear and bull market in forex. When making trading decisions, remember to always take into account your personal trading goals, risk tolerance, and the suggestions of reliable financial experts.

Your Bull market playbook

- Surf the Wave: You may consider the upward momentum but don’t try to outsmart the market by making frequent trades based on short-term fluctuations.

- Diversify: Smart investors consider spreading their trades across different asset classes, sectors, and geographies.

- Stay vigilant: Monitoring your portfolio to make sure it reflects your trading goals is important.

- Quality Over Quantity: Trading with companies with solid financials, sustainable business models, and competitive advantages can be an important element.

- Emotional Check: Don’t let the party atmosphere cloud your judgment. Keep a disciplined approach, follow your plan, and assess your risk tolerance.

Your Bear market playbook

- Protect Your Trade: Investors may take into consideration moving towards preserving capital, which may involve reducing stock exposure or turning to less volatile assets.

- Review and Rebalance: You may take a close look at your asset allocation and diversify if you’re heavily leaning towards equities.

- Hunt for bargains: You may look out for quality assets at discounted prices. Patience and vision are key.

- Stick to the plan: Don’t make impulsive decisions based on rapid market volatility. Focus on your trading goals.

Key Takeaways

- Knowing the characteristics of the bear and bull market in forex is crucial for developing dynamic trading strategies and managing risk effectively.

- Keep a close eye on economic reports as they can greatly influence the bear and bull market in forex, indicating when to enter or exit trades.

- Be aware of Central Bank decisions on interest rates and quantitative easing, as they are significant drivers of currency strength and therefore of the bear and bull market in forex.

- Recognize the impact of political events and global market sentiment, which can shift the bear and bull market in forex abruptly, affecting trade values.

- Adapt your trading strategy to align with the current market trend, whether it’s the bearish or bullish phase in the bear and bull market in forex, to optimize your trading outcomes.

Conclusion

As you navigate the volatile environment of forex trading, keep in mind that both bull and bear markets present different opportunities. Bull markets can bring the thrill of asset prices getting higher, while bear markets test your resilience and strategic prowess. Most importantly, neither market lasts forever, and the pendulum constantly swings between the two.

Stay positive, keep learning, and happy trading!

Disclaimer: The information in this article is provided for educational and informational purposes only and is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.