9 Popular Economic Indicators in Forex

In the fast-paced world of forex trading, knowledge is power. Being able to indicate market moves and make informed decisions are essential elements when it comes to forex trading. Economic indicators in forex trading can play a pivotal role in this regard, serving as crucial tools for traders to gauge economic health and indicate potential currency movements. Let’s find out some of the popular economic indicators in forex trading.

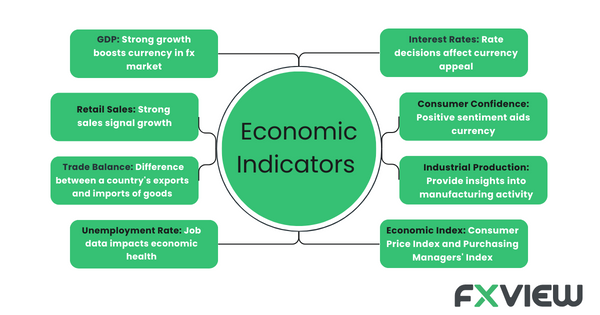

Economic Indicators in forex trading:

In the forex market, economic indicators are like guiding stars. They may offer critical insights into a country’s economic health, which may help traders indicate potential currency movements. These indicators can be leading, lagging, or coincident, offering varying degrees of predictive power.

1. Gross Domestic Product (GDP): GDP is the heartbeat of a nation’s economy. Forex traders scrutinize GDP reports because they reflect overall economic growth. A robust GDP can often lead to a stronger national currency as it indicates a healthy economy.

2. Consumer Price Index (CPI): CPI is a forex trader’s thermometer for inflation. Rising CPI may suggest potential currency depreciation due to eroding purchasing power. Conversely, low inflation can be favorable for a currency.

3. Unemployment Rate: The unemployment rate can act as a barometer of a nation’s labour market. In forex trading, lower unemployment rates might generally be positive, indicating economic strength and potential currency appreciation.

4. Retail Sales Data: Retail sales data can offer potential insights into consumer behaviour. Forex traders may watch this indicator closely, as robust retail sales can indicate a strong economy and a potential uptrend in the national currency.

5. Interest Rates: Interest rates are like the tides of forex trading. Central banks can use them to manage economic stability. A rise in interest rates can attract foreign investment, strengthening the currency. Conversely, rate cuts can weaken it.

6. Trade Balance: Forex traders view the trade balance as a scale. A trade surplus (more exports than imports) can tip the scale toward currency appreciation, while a trade deficit may push it in the opposite direction.

7. Consumer Confidence Index: The Consumer Confidence Index reflects the mood of consumers. Higher consumer confidence may often lead to increased spending, which can boost economic activity and strengthen the currency.

8. Purchasing Managers’ Index(PMI): Forex traders regard PMI as a leading indicator. Rising PMI levels signal economic expansion, which can be a positive sign for the national currency.

9. Industrial Production: Industrial production data can provide insights into manufacturing activity. Forex traders keep an eye on this indicator to potentially gauge economic health. Strong industrial production can indicate a thriving economy and a potentially stronger currency.

Potential Advantages of Using Economic Indicators in Forex Trading:

- Informed Decision-Making: Economic indicators can provide traders with essential information, such as GDP, inflation, and employment data, assisting them in their process of making informed trading decisions. By analyzing these indicators, traders can potentially gauge a country’s economic performance and indicate potential currency movements accordingly.

- Timing Opportunities: Having timely access to economic data can allow traders to seize opportunities in the forex market. For instance, when a positive manufacturing report is released, traders can swiftly take positions that potentially benefit from a stronger currency before the broader market reacts.

- Risk Management: Economic indicators in forex can play an important role in risk management strategies. Traders can use these indicators to assess the overall risk in the market. For example, if trade balance data reveals trade deficits, traders might implement risk mitigation measures to assist with protecting their positions.

- Diversification: Economic indicators may offer diversification in analyzing an economy’s health. Traders can consider a wide range of indicators, such as consumer sentiment, retail sales, and industrial production, to gain a comprehensive understanding of an economy’s performance, reducing reliance on a single metric.

- Long-Term Planning: Forex trading may often involve developing long-term strategies. Economic indicators can provide historical data that traders can analyze to indicate trends and potential long-term trading opportunities. For example, studying GDP growth rates over several years can help traders plan their strategies.

These advantages highlight how economic indicators in forex can serve as helpful tools for forex traders, providing them with potential insights and capabilities important for making informed decisions, and constructing a risk management approach and a dynamic trading strategy. Although economic indicators might seem to be helpful tools for traders, solely relying on them when making trading decisions involves high risk.

Key Takeaways

- Holistic Analysis: Traders should consider a combination of indicators, as no single economic indicator in forex can provide a well-rounded economic picture.

- Economic Calendar: Keep an eye on the economic calendar to stay informed about upcoming releases of economic data. Timely reactions can be critical in forex trading.

- Interconnectedness: Economic indicators in forex are interconnected. Changes in one indicator can affect others and create chain reactions in the forex market.

- Real-Time Monitoring: Continuously monitor economic conditions and indicators to adapt to evolving market dynamics.

- Risk Management: While economic indicators in forex might be valuable, the market inherently carries risks. Using proper risk management techniques in order to protect your capital is essential.

- Adaptability: Be prepared to adjust your trading strategy based on economic data and market reactions.

Conclusion

Economic indicators seem to be helpful tools for forex traders seeking to navigate the complexities of the market with more confidence. They can provide the foundation to assist traders when making informed trading decisions, timing opportunities, managing risks, and developing long-term strategies. However, it’s crucial to remember that indicators should not solely be a source to rely on when assessing your trading strategy, as the forex market is volatile and can involve both potential rewards and risks, so a balanced approach and continuous learning are essential.

Disclaimer: The information in this article is provided for educational and informational purposes only and is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.